USDC vs USDT: Which stablecoin should you use?

The supply of stablecoins quietly increased last year (2020) to $28 billion after starting the year below $5 billion. And the market continues to experience substantial growth. In January 2021, the supply of stablecoins exceeds $33 billion.

The two biggest stablecoins today are Coinbase’s Tether and USDC, which make up the bulk of the market in terms of the total supply. Tether’s USDT accounts for over 75% of the market with $25 billion in total supply. On the other hand, USDC comes in second place, far behind Tether, with 14% of the market and nearly $5 billion in total supply. So which USD-backed stablecoin is the better choice: USDC or USDT?

It is helpful to weigh the pros and cons of each in order to make an informed decision based on your particular situation. But before we get into the details, let’s think more broadly about the fundamentals and the underlying technology.

What are stablecoins?

Stablecoins are cryptocurrencies whose value is backed by another asset, such as the US dollar, euro, yuan, or gold. The price thus remains stable in relation to this asset.

With 24/7 availability, near-instant settlement, and low fees, people are turning to cryptocurrencies to make payments.

The first cryptocurrency, Bitcoin paved the way for blockchain payments. In 2010, Laszlo Hanyecz bought two pizzas from Papa John’s for 10,000 BTC (worth $30 at the time), which is believed to be the first instance of cryptocurrency being used to pay for goods or services. services. At the current value of Bitcoin, these pizzas cost around $350 million.

Bitcoin remains the most popular cryptocurrency used for payments, but its wild volatility makes it problematic for usage and different payments.

Must Watch: 10 Best Cryptocurrencies that will Explode In 2022

This is where stablecoins come in. While many top cryptocurrencies are still in the price discovery phase, you can reap the benefits of blockchain payments without subjecting yourself to volatility or complicated tax calculations. . Stablecoins allow institutions, merchants, and individuals to hold cryptocurrencies without having to deal with the ups and downs of Bitcoin or Ethereum.

How does it work? The issuer of a stablecoin typically holds a reserve in a bank for the asset backing the stablecoin. This reserve will then serve as collateral for the stablecoin. It’s similar to how USDC and USDT back their stablecoins with fiat.

What is USDC?

The USD Coin (USDC) was launched in October 2018 by the Consortium Center, powered by the Coinbase cryptocurrency platform and Circle Internet Financial. USDC is the only stablecoin currently supported by Coinbase. It is built on the Ethereum blockchain as an ERC-20 token.

As of January 15, 2021, USDC is in the top 15 coins on all exchanges. Its total supply stands at $4.75 billion (compared to $518 *million at the start of 2020) and it has a 14.5% market share for all stablecoins. It has quickly become one of the biggest coins, and it looks like it is still gaining some serious momentum.

How is the USDC stabilized? USDC is pegged to the US dollar (USD) and held in reserve bank accounts. It is subject to regular audits to ensure that it remains tied to a real dollar. This is how you can be sure that USDC will equal a dollar no matter what.

USDC can be traded on 7 different platforms today, namely: Coinbase, Binance, Poloniex, and KuCoin. Coinbase Pro or Coinbase Prime users can buy and sell USDC in all regions of the world. If you have USDC on Coinbase, it’s easy to convert it back to fiat and withdraw it to your bank account.

How can I use USDC?

Since USDC is an ERC-20 token, any 2 Ethereum wallets can send and receive USDC to anyone in the world almost instantly.

This ERC-20 based token can be used by any new decentralized application (dApp) built on the Ethereum blockchain. This is why USDC is popular in the DeFi community. USDC holders are free to explore the Wild West of DeFi loans, high-yield savings accounts, and other possibilities.

More recently, USDC partnered with the government of Venezuela to provide assistance to people and healthcare workers in Venezuela. According to the CEO and founder of Circle, stablecoins are now a tool of US foreign policy and the USDC is leading the charge.

What is USDT?

Tether, known by the symbol USDT, is widely recognized as the first stablecoin project. Originally known as MasterCoin, the idea for Tether was conceived in January 2012 and officially launched in 2014 by Bitfinex. It is a fiat-collateralized currency, which means that its value is supposed to be pegged to the US dollar.

The USDT supply amounts to almost $25 billion and represents more than 75% of the total stablecoin supply. It is the third-largest cryptocurrency by market capitalization to date and is the reigning king of stablecoins.

How to use USDT?

Since USDT is the biggest scale stablecoin, it offers great liquidity to its users. USDT notably has a daily 24-hour volume of well over $100 billion, nearly double that of bitcoin. It is the most liquid cryptocurrency in the world.

This makes it perfect for traders who need easy access to transfer funds. You can enter and exit trades without the price changing dramatically (as is the case with Bitcoin or Ethereum). And if you only trade between various digital currencies, the tax liability is less or even non-existent.

Digital currencies can also be used as a medium of exchange, and not just by traders. More and more companies and freelancers are using Tether as a means of inter-company payment.

But Tether is also not without controversy, mainly over whether it is fully backed by the US dollar.

In 2019, Bitfinex, the platform that shares a parent company with Tether, reportedly plundered $850 million from Tether’s reserves for their outstanding debt.

Is it good to invest in USDT or USDC?

Make sure the stablecoin you choose is supported on the network you want to use if you want to use a particular blockchain or DeFi protocol. Although the returns and usage of each may differ, USDC and USDT can be used to lend, stake, and provide liquidity for trading pairs.

| Last name | USDT | USDC |

| CoinMarketCap Ranking | 3 | 4 |

| Circulating Power | 66.98B | 55.78B |

| Creator | Limited tether | Center (By Circle & Coinbase) |

| blockchain | Ethereum, Solana, Tezos, Kusama, Algorand, Avalanche, Tron, Polygon, EOS, Liquid | Ethereum, Tron, Hedera, Stellar, Algorand, Solana, Avalanche, Flow, Polygon |

| Launch year | 2014 | 2018 |

| Audit frequency | Irregular | Monthly |

| Pricing | 1 USDT: 1 USD | 1 USDC: 1 USD |

Can you earn interest on USDT or USDC?

DeFi provides services comparable to those provided with a bank account. Lending your tokens to various sites and receiving interest is one such method. You can benefit from higher APY on less risky digital assets by including stablecoins in your investment portfolio.

Even though interest rates fluctuate frequently, you will generally make more money lending your stablecoins than holding your money in a traditional savings account. Compared to a conventional bank, you will also have a real choice over where you decide to put your money.

Also Read: GTA 6 to include a cryptocurrency rewards system?

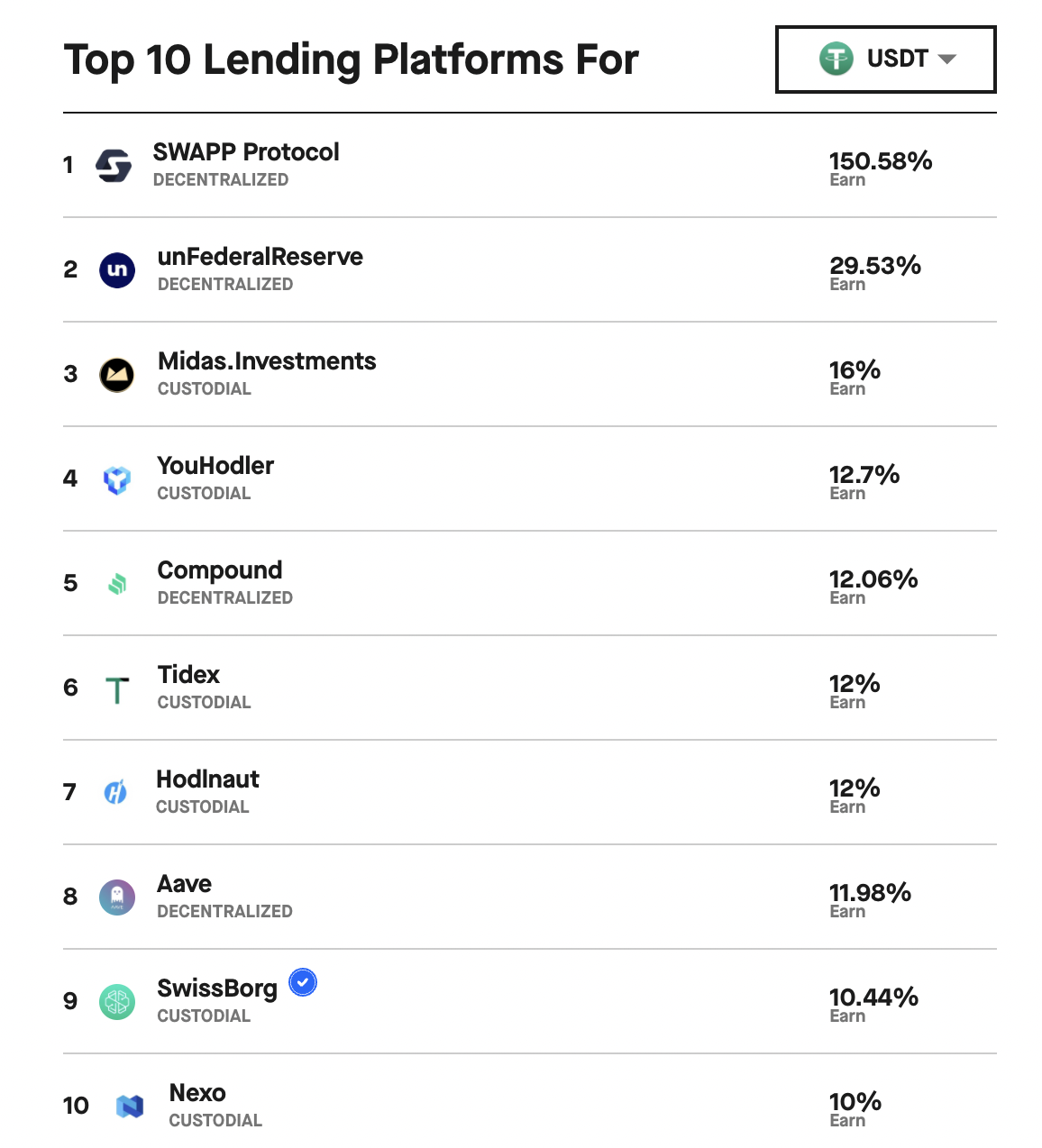

One tool where you can see the current APY across multiple coins is DeFi Rate. The top 10 lenders listed below offer interest rates for USD coin lending ranging from 2-9%, with an average annual percentage yield (APY) of 4.4% each month.

You can view the most recent USDT loan rates using various tools, such as Staking Rewards. The average annual percentage yield (APY) is 150.58%, well above the USDC average.

Given the high potential rewards, there is always risk involved; it is, therefore, crucial to thoroughly analyze each platform and each financial instrument.

Verdict: Which is better USDC or USDT?

Two of the many stablecoins available in today’s crypto ecosystem are USDC and USDT. Although USDT is the most actively traded cryptocurrency, its parent company, Tether, has resisted audits and investigations and mostly avoided discussing the topic of impending regulation. Despite the possibility of significant profits on your USDT investment, Tether’s support for the currency has long been questioned.

Read: 5 Legit Ways to MAKE MONEY ONLINE!

On the other side, the USDC has carefully prepared for potential government oversight of stablecoins. Your downside is still limited by compliance and regular Center Consortium audits, so you can continue to acquire and lend your USD Coin for comfortable gain.

Is USDC safer than USDT?

Yes, USDC is safer than USDT and on the other side, USDT is also safe. But as a trader, I would suggest, you all that you should keep your funds in USDC or BUSD (Because hedge funds are attempting to spread panic and shorting Tether (USDT).

You also let me know your opinion that which is the safest stablecoin?

Which is the Safest Stablecoin?🤔

— Technuto (@technuto) June 30, 2022