Bitcoin Price Prediction 2025: BITCOIN PRICE RISES FOLLOWING THE STOCK-FLOW MODEL WITH A TARGET OF $288,000 USD BY 2025

The short squeeze that triggered the Bitcoin price rally now indicates that the asset is likely heading for a new high. Analysts share a bullish outlook, a recovery in line with Plan B’s S2FX model.

- The highest level of liquidations of short positions in Bitcoin to be recorded on Binance since May 2021, analysts predict another short-term short squeeze.

- Analyst Will Clemente predicted the short squeeze on July 23.

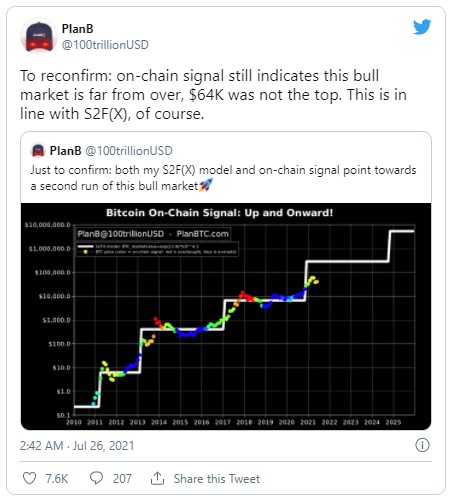

- Plan B confirms the S2FX pattern and chain signals point to a second bull market run.

A SHORT SQUEEZE TRIGGER A PRICE RALLY OF BITCOIN, ANALYSTS PREDICT A SECOND BULLISH RUN

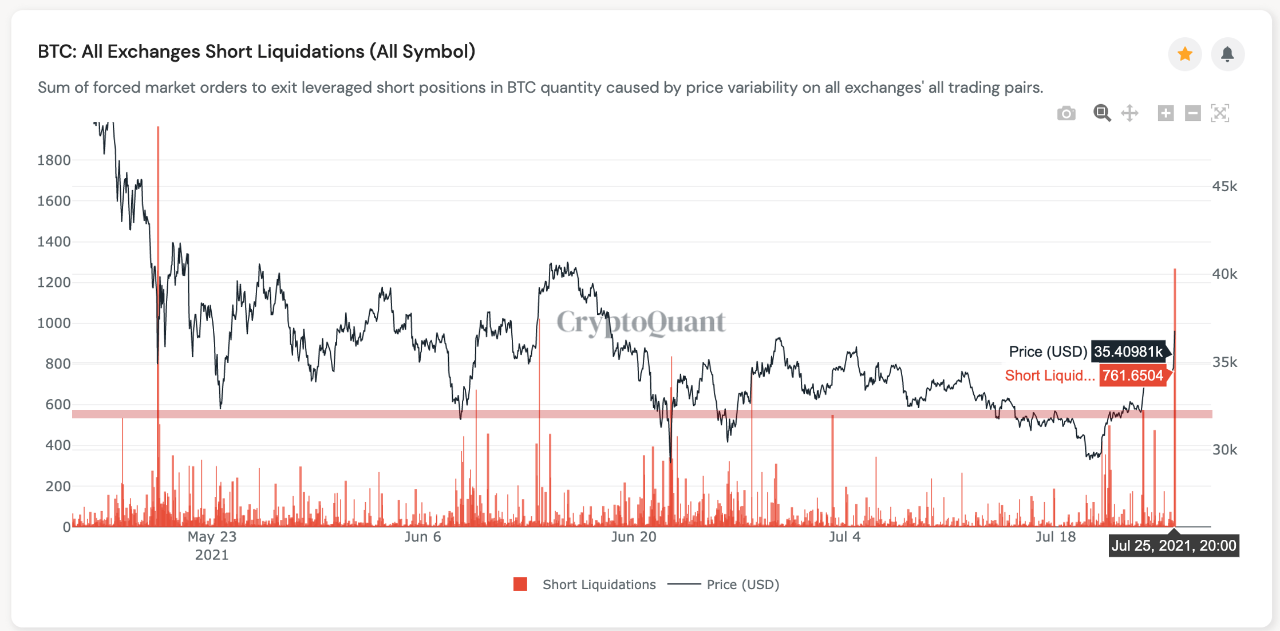

The short positions recorded on Binance reached the highest volume since May 2021 based on data from CryptoQuant. The liquidation of several short positions in a short period of time, over 761 positions in an hour, led to a temporary rise in Bitcoin prices.

The Bitcoin All Short Close On All Exchanges Metric is the sum of the forced market orders that exit leveraged short positions in BTC due to increased volatility on all exchanges, all market pairs. A spike was noted on the chart on July 25, and it acted as a driver for the price of Bitcoin. As a result of this event, BTC broke above the $ 35,400 level.

BITCOIN: LIQUIDATION OF SHORT POSITIONS ON ALL EXCHANGES

A short squeeze is an event in which several short-sellers are kicked out of their positions within a short period of time, usually triggered by a sharp increase in the price of the asset. Although the short sellers were betting on a fall in the price, the rise in the price of Bitcoin resulted in a massive selloff of short positions.

A short squeeze is an event in which several short-sellers are kicked out of their positions within a short period of time, usually triggered by a sharp increase in the price of the asset. Although the short sellers were betting on a fall in the price, the rise in the price of Bitcoin resulted in a massive selloff of short positions.

Since short sellers close their positions by buying, an increase in buy orders is typical. This leads to a temporary rise in prices is accompanied by an equivalent peak in the volume of transactions. Analyst Will Clemente had predicted in advance a short-press event on July 23.

In his email newsletter, “Bitcoin on-chain updates by Will,” Clemente discussed the factors responsible for a supply squeeze and an upcoming Bitcoin price rally. Observing funding rates which have remained mostly negative since late May 2021, Will said:

“Seeing the funding stay negative throughout this pump over the past 24 hours shows that we could potentially be bracing for a short squeeze.”

Analysts like Willy Woo and Plan B have agreed on the short supply narrative compression and the bullish outlook for Bitcoin’s price.

Plan B tweeted:

The cross-asset Stock to Flow (S2FX) model is derived by replacing time and adding silver and gold to the original Stock to Flow (S2F) model proposed by Plan B. The model predicts a price for Bitcoin to $ 288,000 USD by 2024. Based on the analyst’s prediction, the price of Bitcoin aligns with the S2FX pattern and is on track to hit $ 288,000 USD.

By Ekta Mourya, FXStreet

Ekta Mourya is currently pursuing her MBA in finance. She has been working in the cryptocurrency field since 2017. She has held positions in the marketing team of major Indian cryptocurrency exchanges Koinex and CoinDCX. She is interested in day trading and the derivatives market.

The opinions expressed here are solely those of the author and do not necessarily reflect the views of Forex Quebec. Every investment and trading move comes with risk, you should do your own research when making a decision.

KEEP YOUR CRYPTOCURRENCIES SAFE!

The Ledger Wallet is the most advanced storage device for securely holding and using Bitcoin and other cryptocurrencies.

Disclaimer: The information and opinions contained in this report are provided for general information only and do not constitute an offer or a solicitation to buy or sell currency contracts or CFDs. Although the information contained in this document has been taken from sources believed to be reliable, the author does not guarantee its accuracy or completeness and assumes no responsibility for any direct, indirect, or consequential damages that may result from the fact that someone relies on such information.