How to Trade Forex with $10 | How to Trade with Forex Successfully Without A broker & Earn $5000 Per Hour?

The functioning of markets can sometimes seem complicated. In order to remedy this, we suggest you follow these few steps to start trading on forex:

- Choosing the ways to invest in forex

- Find out how the forex market works

- Opening an account

- Develop a trading plan

- Select your Forex trading platform

- Open, monitor, and close your first position

1. Choosing the ways to invest in forex

Most of the forex trading activity occurs between large financial institutions and banks, involving the trading of huge amounts of currency on a daily basis. However, retail investors who lack the financial resources to invest billions of dollars in forex can still participate in this market through four alternative methods: utilizing options, turbos, CFDs, or relying on the services of a forex broker.

What is forex options trading?

With forex options trading, investors can speculate on the price fluctuations of a currency without the need to physically possess it. IG offers two options trading categories: barrier products and vanilla options. Barrier products are call options, linked to the underlying currency pair, that are terminated when they hit a predetermined level called the knockout level.

On the other hand, vanilla options are contracts that grant the buyer the right to purchase a currency at a specific price and time, allowing them to benefit from the difference between the opening and closing prices. Forex is just one of the numerous markets accessible to options traders.

What are forex turbos?

A turbo, which can also be referred to as a turbo certificate or turbo warrant, is a transferable security whose value is determined by the price of an underlying financial asset. It is a transparent investment option for traders who wish to speculate on the upward or downward movement of forex and other markets while simultaneously managing their risk and leverage.

When placing a turbo order, investors can select a knockout level from a variety of available options. If the underlying market hits this level, the turbo will become inactive, resulting in the loss of the initial sum invested to open the position but never more than that. The leverage for the position is determined by the choice of knockout level and deposit amount.

With IG’s turbo24, traders can participate in forex markets without paying any commission, as it is the world’s first 24-hour listed turbo.

What is a forex CFD order?

Forex CFDs are contracts that enable traders to speculate on the price difference of a currency pair between the opening and closing of a position. A long position in a currency pair can generate profits if the pair’s price rises, while a short position can lead to gains if the price declines.

While CFDs are subject to capital gains tax, the losses incurred can be offset with the help of gains. CFD trading is not limited to forex markets and encompasses thousands of other stocks as well.

What is forex trading through a broker?

When investing in forex through a broker or a bank, the process of speculating on the movements of a currency pair is similar to CFD trading. Traders can predict the movement of the currency pair without owning it and can opt to go short instead of buying, anticipating a decrease in the price.

However, unlike CFD trading, investing in forex through a broker or a bank does not provide access to other asset classes or markets.

2. Find out how the forex market works

Understanding the functioning of the currency market is crucial when investing in forex, as it differs significantly from regulated markets like stocks or futures.

Forex is not bought and sold on a centralized exchange, but instead, it is traded through a network of banks in what is known as the over-the-counter (OTC) market. In this system, the banks act as market makers, providing bid and ask prices for specific currency pairs.

Investing through a forex broker

Retail investors typically do not engage in direct buying or selling of forex with major banks but rely on forex brokers to act on their behalf. Forex brokers work with banks to obtain the best available prices and incorporate them into their own market spread.

Certain brokers offer Direct Market Price Access (DMA) that provides traders with direct access to the order book of market makers. Experienced investors can use DMA to buy and sell forex without incurring any spread costs. However, using the rates provided by currency suppliers results in variable commission charges.

3. Opening an account

To invest in forex through options or CFDs, it is necessary to create an account with a broker that offers leveraged trading.

At IG, you can quickly and easily open an account without any obligation. Our registration form can be completed in just a few minutes.

4. Develop a trading plan

Developing a trading plan is a crucial aspect when investing in forex, especially if you are new to the markets. It helps you avoid making emotional decisions and instead make informed ones based on objective rules for opening and closing positions. To spot opportunities in the market, you can also employ a forex trading strategy that suits your goals and risk tolerance.

After choosing your trading strategy, you need to apply it by using your preferred technical analysis tools to determine your first order. However, even with the use of technical tools, you need to stay alert to events that could cause market volatility, such as upcoming economic announcements, which may not be factored into your analysis.

5. Select your Forex trading platform

We provide you with various trading platforms to choose from that cater to your specific needs and preferences, enabling you to trade forex seamlessly and with ease.

Whether you prefer to trade through our IG trading platform, one of our mobile apps, or even an advanced third-party platform like MT4, you can enjoy features such as customized alerts, interactive graphics, and effective risk management tools.

6. Open, monitor, and close your first position

Once you have familiarized yourself with your chosen trading platform, it’s time to make your first forex trade. This involves opening an order ticket for the currency pair you want to trade, which will show you the current bid and ask prices. You can then set the size of your position and add stops or limits to automatically close it when prices reach a certain level.

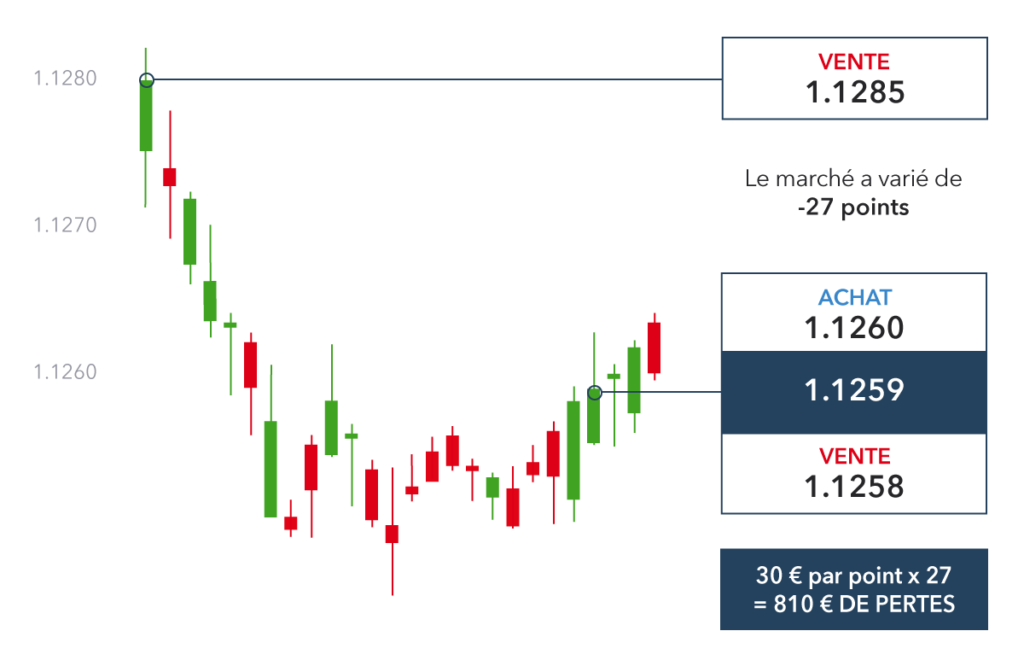

If you believe that the price of a currency pair will rise, you would open a long position by clicking “Buy.” Conversely, if you believe that the price will fall, you would open a short position by clicking “Sell.” You can monitor your position’s performance in the “Positions” tab of the platform.

When you are ready to close your position, you will need to do the opposite of your initial trade. For example, if you bought a currency pair, you would sell it to close the position.

To illustrate the possible outcomes of a forex trade, let’s consider an example. Say you opened a long position on the EUR/USD currency pair at 1.20, with a position size of 10,000 units. If the price of EUR/USD rises to 1.25, you could close your position and realize a profit of $500 (0.05 x 10,000 units). However, if the price falls to 1.15, you could close your position and suffer a loss of $500 instead.

Examples of Forex Trading & How to Trade Forex with $10

Trade GBP / USD with Knockout Barrier Products

When trading deactivating barrier products on IG’s platform, you’ll encounter four distinct prices: underlying market prices for puts and calls, as well as opening and closing prices for the option contract.

The opening price is the difference between the underlying market price and the knockout level, which is the predetermined level at which your position will automatically close if the market goes against you. Additionally, the cost of the knockout protection is included in the opening price. This cost is only incurred if the knockout is triggered and is designed to protect against slippage.

Also Know: How I Made Millions By Just Liking Facebook Page?

Trading deactivating barrier products with IG involves four different prices: the underlying market prices for puts and calls, and the opening and closing prices of the option contract. The opening price includes the cost of the knockout, which represents the cost of protecting the knockout from slippage, and is only billed if the knockout is triggered. The closing price includes the market spread.

For instance, if you believe that the GBP/USD market will rise, and you buy ten contracts each equal to $1 per movement point, with a knockout level of 12,600, and the underlying market price for a GBP/USD call barrier is 12784.0, then the total amount to pay to open your position would be $1,860 premium, along with a commission of $1.

If your prediction is correct and the price of GBP/USD increases by 100 points to 12884.0, you can sell your position at the new sell price of 285.2 (including a commission of $1) and earn a net gain of $990.

However, if your prediction is incorrect, and the market drops to 184 points, triggering your knockout, you will only lose the $1,860 premium paid at the opening. You will also have to pay a $2 commission and an overnight funding fee if you keep your position open overnight.

Similarities Between Options, Turbos, CFDs, and Investing Through a Broker

Regardless of the method you choose to trade forex, such as forex CFDs, forex options or turbos, you will be speculating on the price changes of currency pairs rather than individual currencies.

Leverage is available to retail forex investors, allowing them to gain exposure to large amounts of currencies without paying the full value upfront. In the case of options, the option premium represents the maximum risk if the market moves against you, while the potential earnings are unlimited if prices rise.

Writing options works differently, with the premium received at the opening representing the maximum gain, but with the potential for unlimited losses if the market turns against you.

Turbos work the same as call options when it comes to the initial down payment, as it represents your maximum risk and no further payments are required. CFDs require only a hedge to open the position, but gains and losses are calculated based on the total value of your exposure, which means they can occur more quickly and to a greater extent than your initial deposit.