What is a Hedge Fund?

Contrary to what its name might suggest, a hedge fund or alternative fund is not a common fund or an investment strategy, but a fund management establishment. It is set up by a fund manager or an investment adviser.

Hedge funds use their clients’ capital to generate profit in the markets, using different investment or trading strategies. In other words, investors place their money in hedge funds to invest for them, against management or performance fees.

Hedge Fund Investment History And Structure

Hedge funds were born in the 1950s. Their particularity lies in the fact that they use active management compared to traditional funds.

History of Hedge Funds

As we have seen, the concept of hedge funds dates back to 1949. Alfred Winslow Jones designed an investment strategy at the time, that he considered to be more efficient than those used by traditional funds at the time. Thus, he imagined a portfolio composed of buying, selling, and margin (leverage) positions, in order to increase his potential return.

Must Watch: Top 10 Crypto Exchanges with the Lowest Fees!

In 1952, Alfred changed the structure of his company by transforming it into a limited company and then charged its investors a 20% commission, based on performance. Other hedge funds have followed his active management model. Hedge funds then enjoyed success in the 1970s, when these institutions managed to outperform traditional funds. However, not all hedge funds have been successful, some have ceased operations after losing a large part of their capital.

One of the most successful hedge funds in history, Bridgewater Associates, founded by Ray Dalio in 1975, is still in operation. Bridgewater Associates has assets under management of over $160 billion.

Where does the name hedge fund come from?

The term “hedge fund” originates from the fact that some fund managers simultaneously open long and short positions in stocks. This is a form of hedging called hedging. Hedging is a stock market term that involves limiting risk by opening two opposing positions that are roughly the same size.

However, hedge funds use different types of strategies and trade in all types of financial products, not just stocks. The first hedge fund was established in 1949 by Alfred Winslow Jones, an Australian investor.

What is the purpose of hedge funds?

The purpose of hedge funds is simple: to grow the capital of their clients. They attempt to generate profit regardless of the market conditions: bullish, bearish, volatile, etc. The hedge fund manager, therefore, acts as a trader. It adapts its strategy according to market fluctuations.

Hedge Funds Investment Structures

According to the SEC, the hedge fund is “a private, unregistered type of mutual fund that uses sophisticated hedging and arbitrage techniques to transact in the funds market.” Unlike traditional funds, which derive their performance in correlation with the markets, hedge funds seek absolute performance that is not based on any benchmark.

Also Read: Trade Forex Successfully Without A broker & Earn $5000 Per Hour

Investors are therefore more exposed to the strategies employed by the hedge fund than to the markets. Investors who turn to hedge funds are therefore looking for a performance that exceeds that of the market. Hedge funds thus engage in active management, using riskier financial products than traditional investments.

What instruments do hedge funds trade?

Unlike mutual funds, which are often limited to stocks and bonds, hedge funds can trade in a wide range of financial instruments.

- Stocks,

- Obligation,

- Mutual Funds,

- Forex,

- Cryptocurrencies,

- Immovable,

- Derivatives (futures, options, swaps, etc.).

This diversity has enabled hedge funds to attract investors wishing to diversify their portfolios. There are nearly 15,000 hedge funds around the world that manage over $3 trillion today.

Who typically invests in a hedge fund?

Hedge funds often define a minimum capital to entrust to them. This is generally around 50,000 euros. So it’s aimed at a certain type of investor.

- wealthy people,

- Banks,

- Financial Institutions,

- Pension funds.

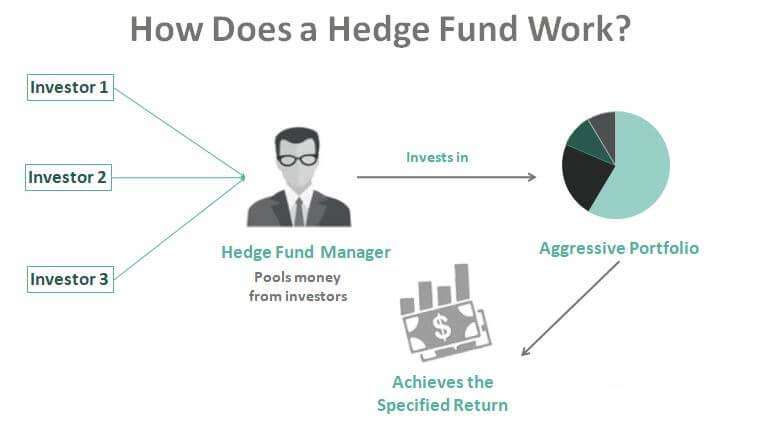

How does a hedge fund work?

Hedge funds operate on the basis of a partnership between investors and fund managers. They convince their prospects of the reliability of their investment approach. When an investor places their money in a hedge fund, they are typically charged two types of fees: management fees and performance fees. We will discuss this subject later.

Characteristics of a Hedge Fund

- Some hedge funds only accept capital from accredited investors.

- Depending on their objectives, they get involved in all derivative markets and products. They can use complex strategies.

- They use leverage, borrowing additional funds to generate positive alpha.

- Most hedge funds apply the “2 and 20” fee structure. That is to say 2% management fee and 20% performance fee.

Hedge Fund Leverage

Hedge funds use leverage to boost their profitability in the markets. They can do this in different ways:

Margin Trading: Margin trading involves borrowing funds, so you can open larger positions. The hedge fund can borrow these funds from investment banks.

New! 10 Best Cryptocurrencies that will EXPLODE!

For example, with a margin of €500, he can borrow an additional €500 from the investment bank, to buy a stock at €1000. If the share goes up to €2,000, he wins €1,000 instead of €500, which he would have received if he had only used his initial €500.

The line of credit: the hedge fund can borrow from a bank, to have more funds to negotiate. The principle is the same as for margin trading.

Hedge Fund Fee Structure

As we have seen, the industry standard for the commission is “2 and 20”. The hedge fund charges a 2% fee per year, taken from assets under management, regardless of performance and market conditions. In addition to these management fees, the investor pays performance fees, when the hedge fund has succeeded in generating a capital gain on its investment. These performance fees are generally 20%.

Hedge Fund Strategies

Since the creation of the first hedge fund, many investment strategies have been developed. Some are simple buy and hold, others are more complex and use derivatives.

Macro-Economic Approach

A macro-economic strategy is relatively simple and is mainly based on economic indications such as GDP or interest rates, but also on political events.

Also Read: What is Blockchain?

For example, suppose the United States decides to lift all sanctions against Iran. This would result in the country being able to produce and export more oil, resulting in increased global production. So the hedge fund could speculate on falling oil prices.

Multiple Strategies (multi-strategy)

Hedge funds with a multi-strategy approach use a variation of financial instruments to beat the markets. They do not specialize in any particular method. Their goal is to make a profit regardless of the market situation. These hedge funds tend to be very conservative and place great emphasis on risk management.

Event-Driven Strategies

With an event-driven approach, the fund manager often tries to take advantage of microeconomic events, concerning a company or a sector. This is actually news trading.

Also Read: What is Web3?

For example, profit warnings are often accompanied by a decline in the stock of the company issuing it. The hedge fund can take advantage of this phenomenon by selling the security short. The event-driven approach, therefore, makes it possible to take advantage of short-term fluctuations.

Long-Short Equity

This strategy is the simplest in the equity markets. It involves buying undervalued stocks and selling overvalued stocks. Hedge funds can be either buyers or sellers in this market. The advantage is that they can take advantage of both rising and falling markets.

The hedge fund can have 3 approaches when it comes to long-short equity:

- Long-biased: the hedge fund is more exposed to buying than selling short, in other words, its long positions are larger than its short positions.

- Dedicated short: the hedge fund is more exposed to selling.

- Market neutral: long and short positions are fairly balanced.

Relative Value Arbitrage

This is a strategy that hedge funds use to take advantage of the price difference that exists between two similar assets. Arbitrage amounts to simultaneously buying and selling two assets, which are judged not to be quoted at their true value.

Also Read: What is Etherscan?

The trader, therefore, sells the asset that is overvalued and buys the asset that is undervalued. So when their prices return to equilibrium, they liquidate those positions. Arbitrage can be used for two stocks, two commodities, two bonds, etc.

Vulture Fund Strategy

This type of speculation consists of buying the debt issued by companies in difficulty at a low price. The objective is to take advantage of this during the debt restructuring phase when the company regains its financial viability.

Quantitative Trading

Quantitative hedge funds are increasingly present in the markets, and traditional hedge funds are beginning to adopt quantitative strategies. The quantitative analysis consists of developing algorithms, which will be the basis of automated trading on the markets.

Also Read: What is NFT and How Does NFT Work? The Ultimate Guide

Quant trading is based on a systematic and non-discretionary approach. Trading robots are responsible for making investment decisions instead of the manager, who is still always present to monitor the progress of operations.

Hedge Funds vs Mutual Funds

The notions of hedge funds (alternative funds) and common funds can lead to confusion. Their main difference is that hedge funds use leverage and derivatives while mutual funds are limited to more traditional investments.

Don’t Know: How to Start a Blog And Earn Money?

What is the Difference between Hedge funds and Mutual funds?

Mutual Funds

Mutual funds are like companies, collecting several financial securities to diversify. When the investor places his money in a mutual fund, he becomes a shareholder of the fund. You own part of the fund.

Unlike hedge funds, mutual funds are limited to traditional and less risky investment strategies: purchases of stocks and bonds. They do not do short selling or high-frequency trading or Forex trading or derivatives.

There are several types of mutual funds, which have different risks and returns.

- index funds,

- The labor-sponsored investment fund,

- Fixed Income,

- Balanced,

- Growth/equities,

- Money Market,

- Closed capital.

Hedge Funds

Hedge funds also pool the capital of investors, but are not marketed as securities. They are less accessible, insofar as these institutions require several tens of thousands of euros to be able to integrate their capital.

They are not subject to investor protection rules established by market authorities for mutual funds. Their investment strategies are therefore often more aggressive and they seek to outperform the market. And this, by using a leverage effect as well as derivatives.

Hedge funds are also a way to diversify from mutual funds. For example, if you only have mutual fund securities, you risk only being in a long position on the markets. This translates into poor performance in the event of a fall in the markets. However, when you put your money in a hedge fund you reduce your downside exposure as the managers use proactive hedging strategies.

What is the Risk Associated with Investing in Hedge Funds

Investing in hedge funds is very risky. It is important to understand that when the hedge fund is profitable, it shares the capital gains with the investor. On the other hand, if the hedge fund loses money, only the investors lose, unless the manager puts his own capital in the fund. The risk of losing is therefore often entirely on the side of the investor.

You Must Have a Look: Top 10 Metaverse Coins You Must Buy!

The use of leverage and derivatives further increases the risk. But hedge funds use the latter to set up complex and sophisticated hedging strategies.

Hedge funds often do not disclose their investment strategies for fear of losing their statistical advantage on the markets (trading edge). They can however inform investors of the outline of their approach and the products they use.

Advantages and disadvantages of Hedge-Funds

Hedge funds are less controlled and therefore less transparent than traditional funds. Managers often impose a period during which you cannot withdraw your invested capital.

Clients often have to wait one to three years before they can have all their capital again. If during this period, the hedge fund to which you have entrusted your money is not profitable, you may become impatient.

New! Can Shiba Inu reach 1 cent?

It is important to point out that hedge funds also get bad press, wrongly, due to the fact that they often profit from crises and flash crashes. But while some hedge funds take advantage of these events, others lose. In addition, they participate in the liquidity of the markets, so that any investor finds a counterpart more easily.

Hedge-Fund Regulation

Although hedge funds are required to register with financial market authorities, their management method is not fully regulated, compared to traditional funds.

In France

In France, hedge funds, or alternative funds are under the authority of the AMF. More precisely, funds of alternative funds are regulated by the AMF. In accordance with EU Parliament Directives 2011/61, all funds established in the European Union benefit from a European passport, which allows them to market their offer throughout the economic zone.

United Kingdom

The UK is the largest hedge fund market in Europe. A hedge fund established in the United Kingdom must register with the FCA (Financial Conduct Authority). Hedge fund managers are also subject to the rules introduced by MiFID II in the United Kingdom. These rules relate to investment and marketing strategies.

In the USA

In the United States, hedge funds are regulated in the state where they are established. If the manager has less than 25 million regulated assets under management, the institution is not required to register with the SEC (Securities and Exchange Commission).

In Latin America

In Latin America, hedge funds are subject to the regulation of the competent market authorities. Here are the market watchdogs of the region’s top 4 economies.

| Country | Regulatory authority |

| Brazil | Brazilian Securities and Exchange Commission |

| Mexico | Ministry of Finance and Public Credit and CNBV |

| Argentina | National Commission of Valores (CNV) |

| Colombia | Superintendencia Financiera de Colombia |

In Asia-Pacific

| Country | Regulatory authority |

| Japan | Financial Instruments and Exchange Act (FIEA) |

| Australia | Australian Securities and Investments Commission (ASIC) |

| China | China Securities Regulatory Commission (CSRC) |

| hong kong | Securities and Futures Commission (SFC) |

The 5 Largest Hedge Funds in the World and their Strategies

The United States is the undisputed master of the hedge fund market. It is home to the largest hedge funds in the world.

| Hedge funds | Assets under management (in billions of dollars) | Main strategy |

| Citadel Investment Group | 218 | Multi-strategy/commodities |

| Berkshire Hathaway | 208 | Long Equity |

| Renaissance Technologies | 113.6 | Arbitration |

| AQR Capital Management | 89.6 | Multi-strategy |

| OF Shaw | 80 | Quantitative trading |

Debate and Controversy

Although they are important players in the financial markets, hedge funds do not have a good reputation. They are often accused of profiting from collapsing societies and financial crises.

Systemic risk

History has shown that hedge funds were key players in the financial and even economic sphere. After the collapse of Long Term Capital Management (LTCM) in 1998, the world realized that it posed a systemic risk. LTCM was a well-known hedge fund in the United States but was in debt up to 25 times the size of its capital (leverage 1:25).

Systemic risk describes the possibility of a series of correlated failures between financial institutions. This typically emanates from a particular institution or sector: a bank or hedge fund. The fall of LTCM caused a liquidity crisis in the United States.

Learn More: 5 Legit Ways to MAKE MONEY ONLINE!

This systemic risk that hedge funds represent is partly due to the fact that large banks have prop-trading branches, which often operate like hedge funds. In addition, the trading of certain leveraged derivatives is handled by investment banks. That said, hedge funds expose banks to the risk associated with their trading activity. The bankruptcy of a large caliber hedge fund can thus upset the financial markets and an entire economy.

Bad Press

Hedge funds are often singled out for excessive speculation in the markets since the fall of LTCM in 1998. Moreover, most of them barely manage to beat the market.

CEM Benchmarking, a Toronto-based investment consulting firm, compared the profitability of 382 large hedge funds with that of stock and bond indices. CEM then discovered that hedge funds failed, on average, to beat the market on an annual basis, between 2000 and 2016. In other words, traditional funds would easily have outperformed hedge funds.

Lack of Transparency

You have probably understood that hedge funds are not the most transparent financial institutions. Investors generally do not know what the managers are investing in, because these are often complex instruments. This is why it is recommended to approach a financial adviser before making the decision to invest in a hedge fund.

Conclusion

Hedge funds are both sophisticated and controversial investment vehicles. They take on more risk, in an effort to outperform the markets. To do this, hedge funds use complex strategies, using derivatives and leverage.

Also Read: How I Made Millions By Just Liking Facebook Page?

Studies have shown that “beating the markets” is not always easy, despite the large resources committed by hedge funds. However, they remain quite an attractive solution for investors looking for absolute growth. Finally, they allow you to diversify compared to traditional investments.

FAQs:

- What is the minimum investment for a hedge fund?– There are alternative funds that accept a relatively low investment, starting at €25,000.

- Is a hedge fund riskier than a mutual fund?– Yes.